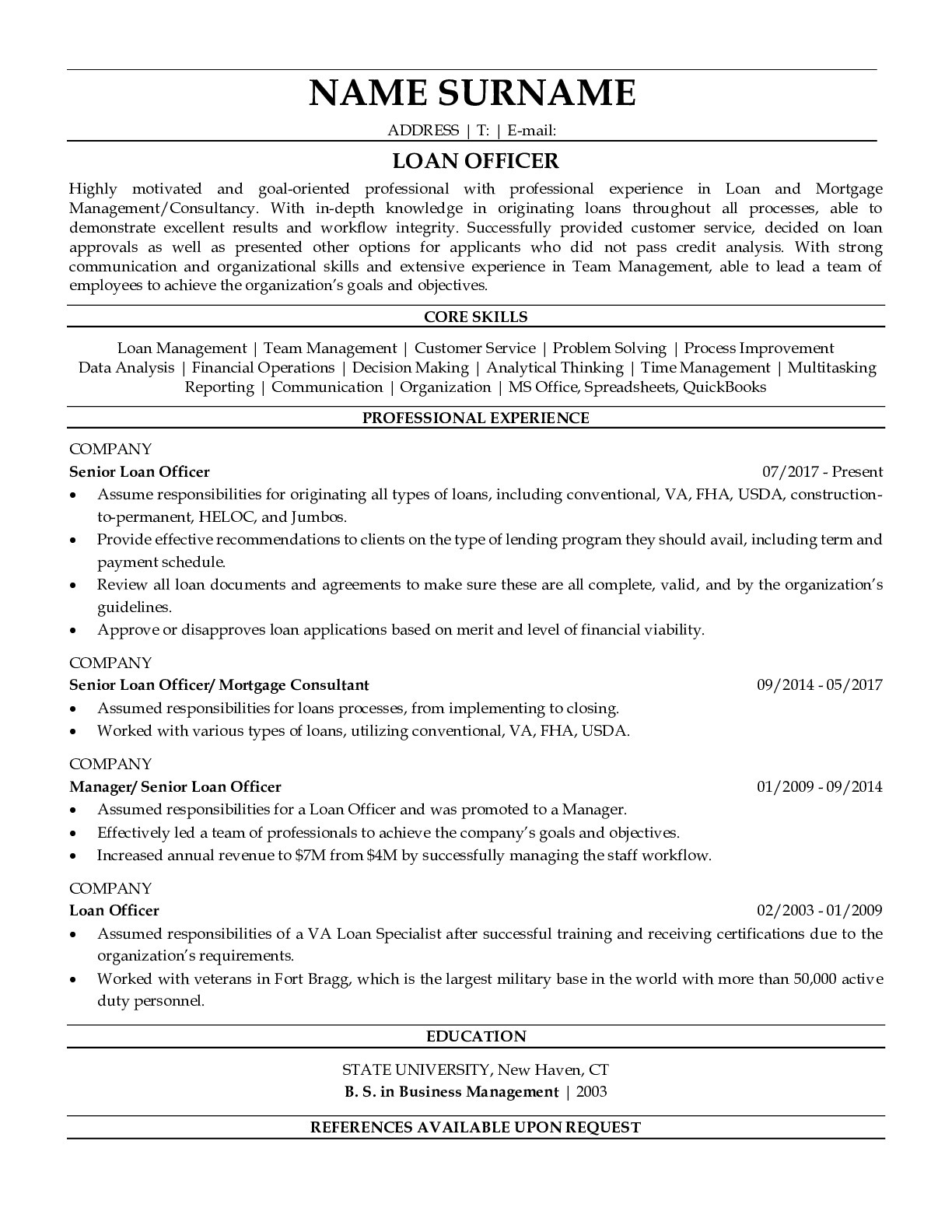

Resume Example for Loan Officer

How to Make a Resume for a Loan Officer

The effectiveness of banking structures manifests itself, above all, in the ability of the bank to increase its loan portfolio while improving its quality and, consequently, reducing the percentage of overdue debt. When writing a resume for the position of a loan officer in 2024, it is necessary to describe not only the key knowledge of the banking industry; it is necessary to specify additional points, such as the experience of working as a loan officer, to positively stand out against the background of others.

You can add a description of specialized financial skills and a thorough knowledge of various financial instruments in this area. In the resume, you can add non-important skills that are not relevant to the specialty but are pretty important in the professional plan, so you can highlight this information in your resume because, in this profession, it is necessary to work with the finances of clients of banks. In addition, a person in charge of a loan officer will not interfere with the work of a psychologist's skills and a high level of intuition so that he could even determine, in the time of dating and the first communication with a potential client, how pure his intentions are, whether the fraud from such a client will be on harm to banking interests.

This is important so people who occupy the position of loan officer bank periodically send to special psychological courses. The main purpose of the loan officer is not simply to arrange an agreement and issue a loan but to arrange an agreement with a trusted borrower, that is, to reduce or prevent the risks of non-repayment of funds allocated by a bank and to provide the bank with profits from the concluded agreement.

Job description

Who is a loan officer? How to get a loan?

A loan officer is a person who deals on behalf of the borrower with a loan. The contract is a party to the obligation. Therefore, the contract specifies the specific conditions for repayment of the loan. These terms are predefined and prescribed in the agreement between the borrower and the loan officer. Only on such terms can we talk about making a loan. The Borrower must present a passport, as a minor can not take out a loan and can not pay. In addition, only by presenting the identity document the bank (loan officer), or financial institution can verify the credible personal data of the potential borrower.

According to the dictionary and encyclopedia, the borrower is a person borrowing something (finance) and should give it away. This term is strictly related to the field of lending. It should also be remembered that the borrower must have full legal capacity. Therefore, he must be 18 years old at the time of taking the loan. If his rights are limited (he is underage), he himself can not do anything. This is a very important thing because such a person can not assume the obligation in the form of a loan.

In addition, not only the individual has the right to take a loan. A participant may be an enterprise that, for example, has financial problems or wants to expand its business. In addition, for the bank and the loan officer, the most important point here is the submission of relevant documents confirming the solvency of the company borrowing a loan or an individual. The higher their current earnings, the better because the procedures for issuing a loan will be successful. This is very important because if a person/company does not have income, then the chances of borrowing are almost negligible.

Skills

When signing a loan agreement, it must be remembered that the loan officer is responsible for all unpaid payments. This happens differently, so the borrower takes care of the financial institution because she gives her a loan and accepts specific debt repayment obligations. If a person who has taken credit obligations does not fulfill them, in this case, the loan officer and the bank have a large number of methods for repaying the loan. One of these methods is selling the assets of the borrower. This is possible because he is a borrower who has not complied with the contract, because of which the loan officer, together with the financial institution, has made more radical steps. When making a loan, always think about its consequences before the loan agreement is signed.

Loan officer: if you want to get a loan, you should always know all your rights and obligations as a borrower because ignorance of the law is harmful. To do this, always read all available documents before you can enter into financial obligations with the loan officer; you can find all the rules, contracts, or withdrawals from the contracts of all the credit companies and many other useful things. Individuals very often use a variety of borrowing tools or methods that they should not use. The Loan Officer deals with the diligent verification of data provided by the borrower, verifies them for accuracy, analyzes them, and makes a final decision on whether or not to provide a loan to a given person.

Examples That May Interest You

Subscribe to our newsletter

Get $15 discount on your first order!