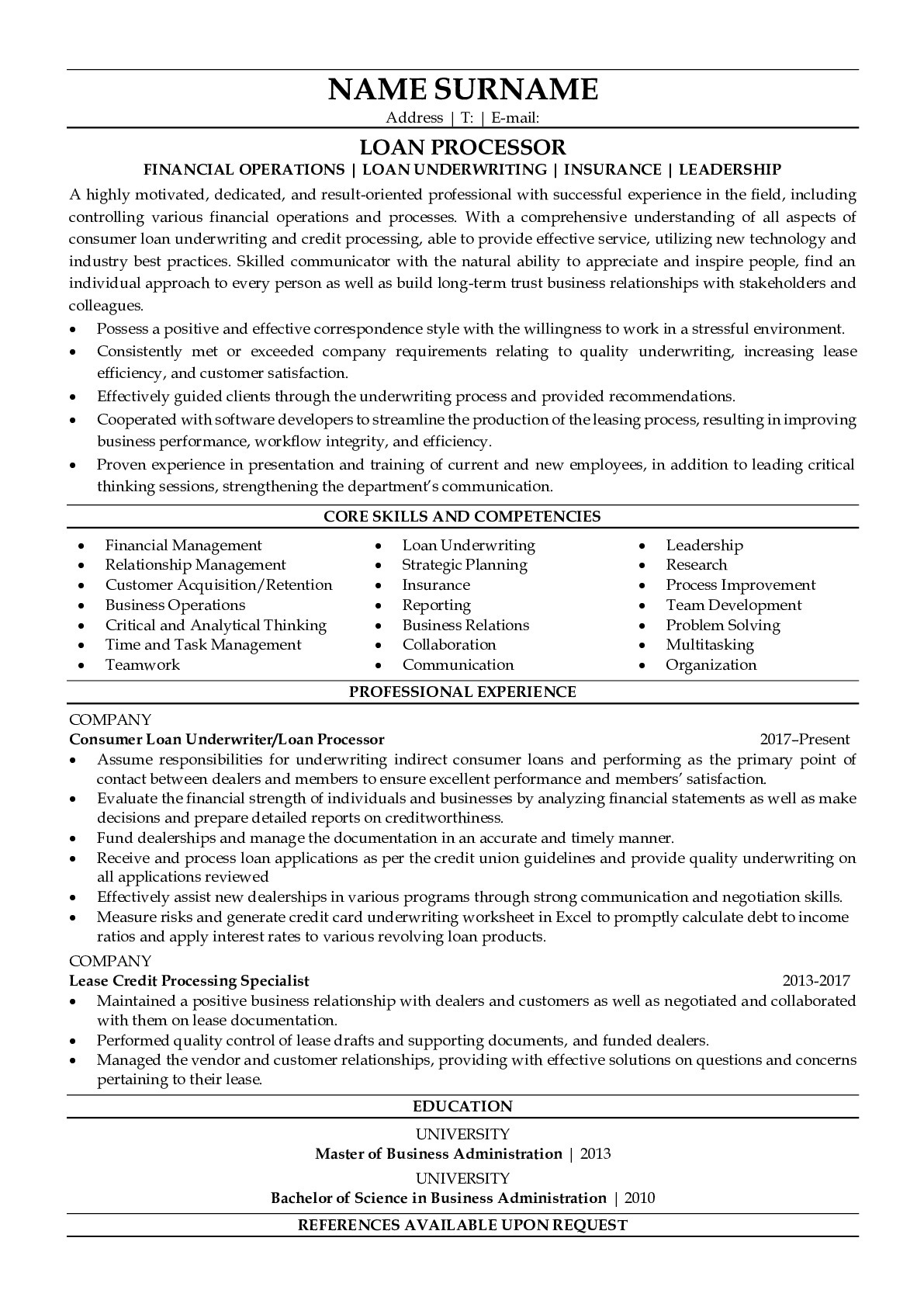

Loan Processor Resume Example with Detailed Description

How to Make a Resume for a Loan Processor

The profession of the loan processor in the modern stage of the labor market is quite in demand in various financial spheres. In connection with the known trends in our time, the number of different financial questions is increasing. The problem with this can be solved by the loan processor, so any banking institution requires a highly skilled specialist in this profile.

When writing a resume for a position in the loan processor in 2024, it is necessary to describe not only the key knowledge of banking but also to add a description of specialized technical skills.

Be sure to describe your own professional skills in the resume, such as:

- defining the cost of work;

- contract work;

- managing and agreeing on design documents;

- conducting settlements;

- writing reports;

- conducting monitoring;

- negotiating.

In the resume, the loan processor can add non-important skills that are not specific to the specialty but are very important in the professional plan so that you can highlight this information in your resume.

But at the same time, at the current stage, many employers do not prioritize the factor of higher education but look at the level of loan processor abilities. The main focus is on the fact that a person as a specialist grows not in educational institutions but during practice, that is, already working in some financial institutions.

Job description

It is known that the effectiveness of the organization is determined, above all, by a successful staffing policy. The effectiveness of banking structures manifests itself, above all, in the ability of the bank to increase its loan portfolio while improving its quality and, consequently, reducing the percentage of overdue debt.

Among the banking professions is the position of the loan processor.

In any case, the loan processor solves a number of important tasks:

- Participates in promoting the Bank's policy in the area of granting loans;

- Provides the most effective information about credit services and products and offers them to potential clients (the most optimal ones for them);

- Engages in an objective assessment of potential clients;

- I learned to make decisions and be responsible for them.

Thus, the loan processor should be an expert in all matters relating to lending, IE, to focus on lending at all its stages: from the moment of acceptance of the application for the loan until the expiration of the loan agreement.

The responsibilities of the loan processor include the following functional objectives:

-

To study a potential client (his banking history);

-

Analyze loan amount and monthly payments;

-

Study statements from clients (borrowers) for a loan;

-

Check the availability of the required package of documents;

-

To study and analyze all potential risks of non-repayment of a loan;

-

Send a complete package of documents of the bank's clients to the bank's security service;

-

To prepare all necessary packages of documents;

-

Sign all important documents;

-

Conduct control.

Skills

A person who works as a loan processor does not interfere with the psychologist's skills so that he can even determine when a customer is honest with the bank when he is dating and first communicating with a potential client.

I also want to point out that in order to fulfill its functions and responsibilities, the loan processor must have a number of personal qualities:

- communicability;

- responsibility;

- tact;

- emotional stability;

- be committed to banking principles;

- have a desire to work with people.

Banks present fairly high requirements for the quality and performance of the loan processor. And this is not unreasonable since it is the loan processor for borrowers that is a person of the ban, and for the bank itself - a very important link of the multi-functional loan mechanism.

Examples That May Interest You

Subscribe to our newsletter

Get $15 discount on your first order!